NOTE: This post originally appeared as my comment to one of Dennis Schaal’s blog posts commenting on Expedia using the term “legacy online travel agency.” Please take a look at the post – not just because Dennis is one of the few bloggers that produces such consistently good quality that I eagerly await seeing his latest points, but because this post inspired a great collection of comments from a number of travel industry players I respect. The combination of the post and the comments provides a great overview of the state of travel industry innovation in May 2009. So with that background out of the way, here is my take on why it is seemingly so difficult for “legacy” travel companies to support organic innovation.

Organic innovation has traditionally been a challenge for Online Travel Companies - who favor acquisitions

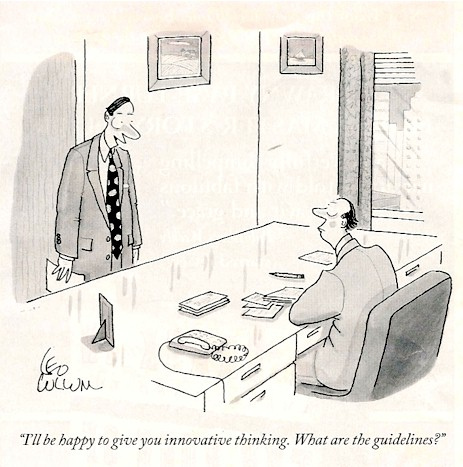

First, the size and investment profile of the Online Travel Companies (OTC’s) applies pressure on the organizations to chase quarterly profits and defer innovative projects that require greater development effort or longer time horizons. As a result, product and development teams are driven to find the proverbial “low hanging fruit” and progress becomes evolutionary instead of revolutionary.

A dozen years ago, when running the hotel line of business at Sabre, I had the pleasure of working closely with a Terry Jones funded team headed by Bob Offutt called Sabre Labs. The group did exceptional work, developed a number of great prototypes and secured several patents.

Despite what I recall as ongoing calls by Sabre’s development establishment to kill the unit, significant consumer facing solutions like parallel search, drive paths, dynamic packaging, budget based flexible date search, collaborative filtering, mobile apps and destination resolution were researched and prototyped.

There was true innovation taking place – I recall the CEO of MapQuest (pre-merger w/AOL) enviously asking “How did you do that?” after a demo of a mapping application.

Much of the innovative work was well ahead of its time, and as a result, was eventually shelved due to extended payback periods or development resource prioritization. Some products, like the flexible air search and Dream Maps were ultimately released, but a lot of what I see on Travelocity today looks a lot like the proofs of concept a decade ago.

These days, it looks like Sabre Innovation Labs has been focusing on internal expense reduction initiatives as opposed to customer facing revenue generating applications.

One should remember many large companies that are driven by quarterly earnings reports often look at cutting $1.00 in expense as adding $1.00 to the bottom line, where adding $1.00 of revenue may drop only $0.15 (if they are lucky) to the bottom line.

The squeeze on development resources has also made build v. buy decisions more straightforward. Building from scratch presents business risk and resource scheduling challenges, where buying an existing technology limits risk to the cost of integration – normally a lower risk scenario if the purchase price works.

In short, the OTC’s have been “innovating” through acquisition for over a decade and list is impressive (and I am sure I missed a few…)

For Travelocity (Sabre), the list includes: Preview Travel, GetThere, site59, IgoUgo, lastminute.com, World Choice Travel, SynXis, nexion, Virtually There and moneydirect. On the back-end Sabre has also acquired , TRAMS, Gradient, Flight Explorer and E-site Marketing.

Orbitz,itself an acquisition and subsequent spinoff from Travelport (the successor of Cendant Travel Distribution Services), has an acquisition portfolio that includes CheapTickets, Neat Group, Lodging.com, travelwire, Flairview Travel (HotelClub and RatestoGo), asia-hotels, ebookers, away.com, GORP, OutsideOnline and Trip.com. On the Travelport side, Wizcom, THOR, Shepherd Systems, Galileo, Worldspan, Gullivers Travel (gta), Octopus Travel, needahotel.com, and Travelbound were also acquired. This list excludes assets that were acquired and later divested by Travelport such as Travel 2/Travel 4, TRUST, Wizcom, and Travelbag. It should also be noted that the Orbitz fare matrix is based on technology externally developed and licensed from ITA Software.

Expedia, since being spun off from Microsoft has acquired Hotel Reservations Network (now Hotels.com), Travelscape, Hotwire, TripAdvisor, Classic Vacations, TravelNow, VacationSpot, Metropolitan Travel, Newtrade, CruiseCritic, SeatGuru, IndependentTraveler, smartertravel, bookingbuddy, Travel-Library, CarRentals.com, VirtualTourist, Venere, and eLong (investment).

priceline.com’s pace of acquisitions has been slower than the others, perhaps because all other travel transaction models were not wiped out by the reverse auction method as originally predicted by founder Jay Walker. Once they diversified into mainstream booking processes, priceline also acquired other travel assets – lowestfare.com, TravelWeb, Bookings.com, BreezeNet, and RentalCars.com.

There are a lot of innovative companies and technologies covered in the list above. It seems the majority of the companies were purchased post-launch after establishing some degree of market awareness and/or commercial success. It appears OTC investment activity has been predominantly Merger & Acquisition based and it does not seem that there has been any material degree of angel, early or late stage venture capital participation by the Online Travel Companies.

Based on the large number of acquisitions, a considerable amount of development effort would be required to integrate the technologies and business processes from these operating businesses into the parent. One could also conclude that these integration efforts, with pressure to quickly gain synergies and eliminate operational redundancy, would gain access to resources that might have otherwise been dedicated to organic development projects.

With recent competitive fee cuts designed to gain share from competitors and supplier sites putting pressure on OTC earnings, the environment for allocating R&D funding to organic development or seed investment are likely to remain constrained. Strategic acquisitions able of drive increased traffic, retain existing customers, reduce costs or eliminate competition will inevitably be continued by the OTC’s.

The more interesting question is if the challenges presented by the global financial crisis will constrain access to sufficient capital for small, innovative travel technology companies to launch and gain enough attention or volume to attract the attention of the OTC’s.

Private capital will determine if innovation continues in the travel industry. Based on the global nature and fragmentation of the travel business, I bet it does.

As a matter of fact, if any angel investors out there have $3-$5 Million in seed money available, I would be happy to discuss a couple ideas I have…