Hotel brands differentiate themselves through a combination of physical attributes, service delivery processes and marketing communications that create a unique character in the minds of travelers.

If the hotel brand fails to provide insight into the guest experience, what good is it? In many cases, hotel brand descriptions are not helping.

Photo Credit: brionv (cc|flickr)

Great branding is all about creating a unique and highly defensible consumer value proposition – ideally, one that allows the company to capitalize on extended lifetime customer value.

The world’s largest hotel chains have recently embarked on an unprecedented period of introducing new lodging brands. Many of these new brands are often described as “lifestyle brands,” designed to appeal to the sensibilities of millennial travelers.

Unfortunately, these fledgling brands are often being bolted onto large hotel chain brand portfolios where consumers are challenged to recall the affiliation of the brand with its respective parent chain. See Hotel Brand Matching Test Results for how the relatively well traveled readers of Views from a Corner Suite scored when trying to match 100 brands from the top ten global hotel brands.

Worse yet, the existing brands are often poorly differentiated from the competitors. This is nothing new. In June 1997, Cornell University School of Hotel Administration marketing professor Leo Renaghan asked the hundreds attending the Hotel Electronic Distribution Network Association (HEDNA) Conference “Can someone please tell me the difference between a Hilton, Sheraton and Radisson?” The response was palpably awkward silence.

He was not being malicious or glib; he asked because a property located in Central New York had been all three over a period of ten years and had never experienced any degree of business disruption while changing brands. The hotel’s management continued to operate the property and the only things that changed were the sign and logoed products.

Renaghan’s cautionary tale was that ineffective branding would eventually put the hotel groups at risk. Poor differentiation could introduce opportunities for third parties to disrupt traditional hotel group roles. Nearly two decades later, that lesson has not yet been learned, but that day of reckoning may be coming.

Below, the descriptions of the 100 hotel brands from the Matching Test are listed. The task will be to select the correct brand associated with each description, which has had references to trademarks, geographic locales and sizes removed. The descriptions are sourced directly from the hotel chain websites. A word of warning – this task is much more difficult than matching a brand to a chain.

Before moving on to the quiz, it is important to look at what is happening and why – because it is not healthy for a hotel industry that is already failing to take the threat of disruptive lodging products like Airbnb or HomeAway seriously.

Because Starwood scored so well in the earlier Brand Matching Test, I will pick on them here. The issues raised are also being experienced by the other major hotel groups as well.

Growth for Growth’s Sake

Starwood has a tough start to 2015. In February, CEO Frits van Paasschen was unceremoniously let go – victim to the double-whammy of not only falling short of Starwood’s own growth projections, but also trailing its publicly-traded competitive set of Marriott, Hilton, Hyatt and InterContinental. Starwood’s share price spiked 2.7% on the announcement, despite the lack of a successor being named.

The message to Starwood from Wall Street was clear GROW. NOW. Or else…

Soon thereafter, interim Starwood CEO Adam Aron introduced a new soft-brand, Tribute Portfolio, setting a target of adding 100 properties by 2020 – certainly music to the ears of the investment community. With 10 properties expected to be added in 2015, the resulting balance of 90 properties to be added over the ensuing four years will be a formidable challenge.

As a point of reference, Starwood acquired the nascent Luxury Collection brand when Starwood acquired Sheraton from ITT in 1998. That soft-brand has been grown to 98 properties, but over a period of 17 years. Marriott founded its Autograph Collection soft-brand in 2010, launching with a group of seven properties under common ownership. After five years, the Autograph Collection has grown to 75 properties.

Given greater competition, plus a measured hotel supply growth forecast, Starwood expects to grow from 2016 to 2020 at a pace 50% faster than Marriott grew its Autograph Collection.

Another growth related challenge facing Starwood is size of he properties it is contracting. Marriott’s Autograph properties, at an average 233 rooms, are 40% larger than the typical property in the Marriott portfolio, due to the relatively high ratio of select service properties. If the average Tribute Portfolio property winds up comparably sized, it would be 33% smaller than the typical Starwood property, due to Starwood’s relatively high ratio of large resort and convention properties.

While the Royal Palm is nearing 400 rooms, the remaining four announced properties come in at an average size under 150 rooms, putting further pressure on overall chain growth results.

Starwood is not fighting Autograph alone. Hilton is ramping up its Curio soft-brand as well – stating that they want to have 350 hotels within the same five year time horizon. Considering the lifestyle brands as well, Marriott plans to open 150 Moxy properties, totalling 25,000 rooms by 2020. Hilton appears more patient with its new Canopy brand, wanting 30 properties by 2017, but ultimately seeking “hundreds” of properties within the next five to ten years.

The widespread strategy to add soft-brands is a comparatively straightforward method for the hotel groups to increase the number of available rooms within a given geographic territory, while continuing to satisfy market fencing defined in existing franchise and management agreements.

If the hotel group can properly position a new brand, it can conceptually be introduced without cannibalizing existing demand for hotels throughout existing hotel brand portfolios. How the hotel brands are differentiated from one-another is critically important for consumers and hotel owner/operator partners.

Significant brand density requires revenue management discipline to offer pricing consistent with market demand and relative brand positioning. That task is easier during periods when demand is strong, but such solidarity may be tested during economic downturns.

Location, Location, Location

Ellsworth Statler coined the famous phrase a century ago when asked about the three factors that dictated a hotel’s success. It remains a foundational axiom for real estate today.

Aron was clear about target markets for the Tribute brand “We know exactly where they’re telling us to be — Paris, London.” A list on a video featuring Starwood Preferred Guest members involved in the Tribute Portfoliobrand development process also included: New York, San Francisco, Hong Kong, Rome & Tokyo.

After the initial 393-room Royal Palm property in Miami (no issues there, it’s a solid international gateway city) the four additional locations have been confirmed as:

- Nashville, Tennessee (Noel Place Hotel, 166 rooms, opening 2016)

- Savannah, Georgia (Unnamed, 173 rooms, opening 2016)

- Asheville, North Carolina (Vandre Nouveau Hotel, 150 rooms, opening 2017)

- Charleston, South Carolina (Unnamed, 100 rooms, opening 2017)

The four additional cities are not exactly pulling from the top of the target list. Starwood senior vice president Dave Marr, has indicated that the Tribute brand will be sourcing its properties from a potential pool of 600 properties globally. Capturing a one-third share of a prospect pool within five years is an admirable goal. The challenge will be to secure hotels in the locations that the guests are demanding.

Whither (or Wither) the Legacy Brands?

As much attention as Starwood’s lifestyle brands may be getting, Starwood still needs to address the challenges facing its large legacy brands. Together Sheraton and Westin represent 53% of Starwood’s overall hotel portfolio and 66% of its room inventory.

Mr. Aron recently admitted its Sheraton brand, needs some work, stating the brand “needs to be significantly reinvigorated” and “we have some hotels that need more focus on the fundamentals of delivering service quality to our guests…” Ouch. Statement like that, in addition to freezing up development efforts, signal inventory losses from brand pruning and the inevitable Property Improvement Program to reposition the hotels – putting additional pressure on organizational growth rates.

Aron further elaborated that the solution to Sheraton’s woes could “only come from top-notch marketing.” One might argue that the fundamentals of delivering quality service are an operational, as opposed to a marketing, challenge. Others might suggest that many hotels within the Sheraton portfolio would require significant capital infusions to update and/or upgrade their facilities to successfully refresh the brand.

Unfortunately, one of the downsides of the “asset-light” strategy that dramatically reduced the real estate held by major hotel groups in an effort to slim down balance sheets, leaves brand management dramatically less control over property-level hotel investment decisions. Starwood owns only 3% of its hotels. 48% are under management contracts and 49% are franchised. Not so long ago, the splits were equal thirds.

The other brands will be pressed to pick up any slack. While Starwood’s W and St. Regis brands are respected, together they represent a paltry 6.6% of Starwood’s total properties and only 5.9% of available rooms. Starwood’s Luxury Collection soft-brand contributes a mere 7.8% of the hotel portfolio and 5.3% of the rooms.

This may be one reason that Starwood recently announced its decision to explore strategic alternatives, with Starwood chairman Bruce Duncan emphasizing, “No option is off the table.” Wall Street’s expectations may simply be too aggressive. Growing while repositioning 2/3 of the rooms is a tall order. Breaking up the group to feed growth hungry competitors might be one option, but that could negate the value of the highly regarded Starwood Preferred Guest program.

Hopeful Hyperbole or Delusional Deception?

Across all the major hotel groups, the flowery adjectives adorning the hotel brand descriptions often appear to be sourced from some warped marketing edition of a Bullshit Bingo Thesaurus.

For example, this is how the new Tribute Portfolio brand is described on Starwood.com:

OUR HOTELS

This isn’t about us. It’s about you. You want more incredible hotels in exciting locations, superior service and the SPG member benefits you love. Tribute Portfolio invites you to discover hotels as unique as you are. Stay Independent.

This may be a personal preference, but when I am trying to select a hotel to stay in, or a hotel brand to affiliate with, it IS about the hotel brand, not the traveler.

That description says very little about the brand, except that they are “incredible” hotels in “exciting” locations with “superior” service. That covers a lot of territory. For someone basing a decision on that description alone, it also creates the perception of an exceptional hotel guest experience. Expectations are set pretty high when booked into an “incredible” hotel – especially one in an exciting location with superior service. Without any detail provided, it sounds like my kind of place.

That’s the problem – guests want the details to understand if the hotel truly is their type of place. If they book and it is not, they get disappointed and vent their frustration on TripAdvisor.

Websites and Pictures Worth 1,000 Words – In an Language You Don’t Understand

The fast-tracked Tribute Portfolio launch happened so quickly that the brand has not yet made its debut in the Starwood Hotels list of brands on its consumer website – not even on the corporate brand pages. It’s not even in the brand footers at the bottom of every Starwood Hotels web page either. There has been an area of the Starwood website created for the Tribute Portfolio, it’s just very hard to find at this point.

Brand websites, striving for consistency, often serve the lowest common denominator, failing to promote the key attributes of the brands. Architectural shots of vacant lobbies/rooms, close-ups of food, or attractive models posed in generic surroundings are the interchangeable puzzle pieces assembled into mood boards masquerading as websites.

Starwood produced a nice teaser video for Tribute Portfolio – very light on specifics, but that is normally acceptable for a brand that does not yet exist. The playful, video does communicate that the hotels will be different.

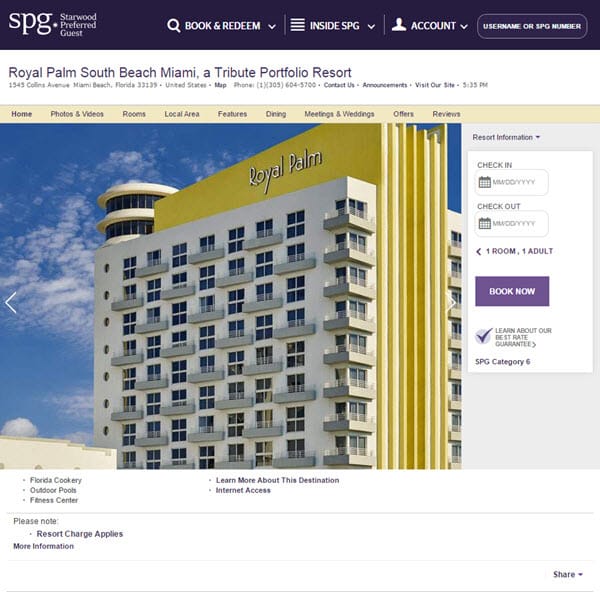

Compare the video with the web page on the Starwood website for the Royal Palm, the first member of the Tribute Portfolio. Most people could not possibly deduce any form of connection between the emotive quality of the video and the web page responsible for closing sales. That is not a good thing.

Screenshot of the web page for Starwood’s founding Tribute Portfolio hotel, the Royal Palm in Miami. It communicates nearly nothing about the hotel, and less about the brand, to a prospective guest.

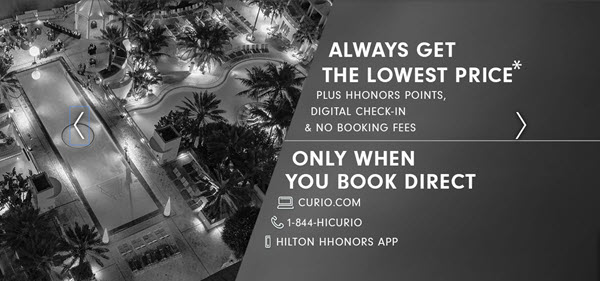

For those feeling bad for how Starwood is executing with its Tribute Portfolio soft-brand, it could be worse. Below is the initial image and copy loaded into the Curio page of the Hilton website. The combination of black & white generic imagery and the heavy handed price/book direct messaging says a lot; just not anything good about its collection of independent hotels.

It’s difficult to imagine what Hilton was thinking by introducing its Curio soft-brand using this design/messaging. Maybe they weren’t…

The Brand Identification Quiz

It will be interesting to see how self-confident industry insiders and travel industry experts perform on this little test. The goal is simple – Match the hotel brand description with the correct hotel brand. If the marketing teams for the major hotel chains have done a good job, it should be easy. The sad reality is that in many cases, you may be lucky to select a brand that is categorized within the same chain scale.

Again, the brand names, trademarks, geographic areas and unit counts have been replaced with generic [Brand], [trademark], [area] and [number] placeholders to avoid providing obvious hints.

Each of the 100 hotel brand descriptions belong to a brand that is a member of one of the top 10 global hotel groups. Each description was taken from its parent hotel chain web site. Again, cheating is no fun – it is much more entertaining to see which hotel groups do the best job of describing their respective hotel brands.

The winner will be the individual who correctly identifies the most hotel brands correctly. In the case of a tie, the earliest submission will serve as the tie breaker.

Good Luck. You will need it. Actually clairvoyance might be much more useful…

The winning prize will again be heartfelt congratulations and a personal sense of a job well done.

The game will close at 23:59 US Central Time on Friday, May 22, 2015. The winner and full answer key will be posted shortly thereafter.